Features

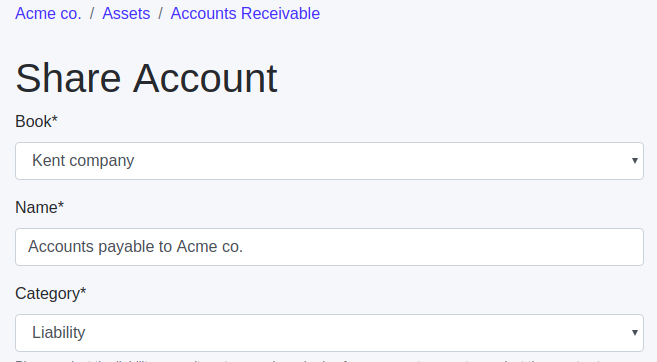

Share ledger accounts between books.

With Cagamee, you link specific ledger accounts between 2 books. For example, if you own 2 companies which transact with each other, you can link accounts receivable of one company and accounts payable of the other company.

Why it's better: Unlike traditional accounting software where you have to enter the same transaction for each book, Cagamee lets you share ledger accounts with another book and saves your time by avoiding double entries.

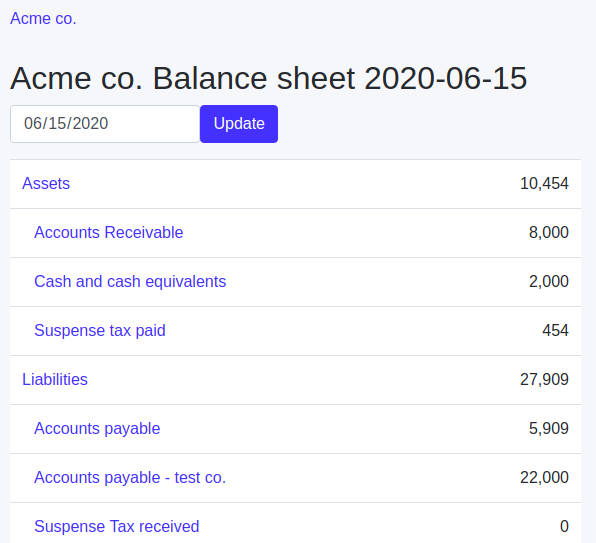

Check the health of your business with financial reports.

Each book on Cagamee is equipped with a balance sheet, income statement, and trial balance.

Why it's better: Because your data is on the cloud, you can view them on any device, whether on your desktop at your office or on your mobile phone. There is no need to ask your accountant to prepare them.

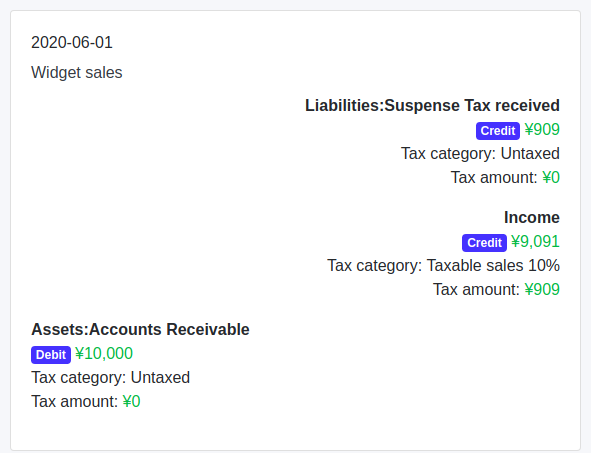

Calculate Japanese consumption tax automatically.

If your business is subject to Japanese consumption tax, Cagamee can keep track of your consumption tax received and paid by automatically calculating tax amounts for transactions and assigning them to appropriate ledger accounts, such as suspense tax paid account and suspense tax received account.

*If your business is located outside Japan and you need to track your local VAT amount, you can still do so by manually entering a tax amount to each transaction.

Why it's better: You can save time and avoid costly mistakes by letting Cagamee handle consumption tax calculation.

Collaborate with your team.

Cagamee lets you invite multiple users to each book you own and assign appropriate access levels. For example, give your accounting department editor access so they can input transaction data, while giving your accountant viewer access so that she can check if transactions are entered according to generally accepted accounting principles.

Why it's better: Instead of exporting CSV data to your accountant who has to import it to his accounting software, give him viewer access to your book so he can see it using a browser.